What is my net worth?

Its a question when it comes to tackling your finances you should be able to answer. We have a good post that explains how to calculate your net worth to help get control of debt.

The net worth formula is pretty simple, its all your assets (real estate, savings, investments, etc.) minus your liabilities or money you owe (mortgage, credit cards, loans, etc.) which equals your net worth.

It is a good indicator of your wealth, but does not mean you are rich.

Many people fail to realize that there is a difference between making money and being wealthy. People may have great earnings (income), but are not wealthy or have a negative net worth balance.

We all do it. See someone in a new car, home, always in the latest fashion and naturally assume that they have a lot of money and they manage their finances well.

Wrong. This is not always the case and often further from the truth. Most of the time these are the people whom are actually bad with money and the biggest spendthrifts.

Checking your net worth is like getting a report card and seeing how your financial grade is doing. The more positive your net worth balance sheet appears the better.

So here at Dream Passively we wanted to track one of our writer’s net worth to see how they graded and fair. We also planned to track their net worth on this site over the course of the year.

Why are we doing this you might ask?

First- to be transparent with our readers and have you fully participate in our journey to becoming debt free. Doing this by practicing what we preach.

Secondly- our method would be helping one of our beloved writers to realize what his debt looks like and take control of it.

Thirdly- we have challenged our gracious volunteer to try and knock down 3/4 of their debt and increase their total asset within the next six months. That is right half the year.

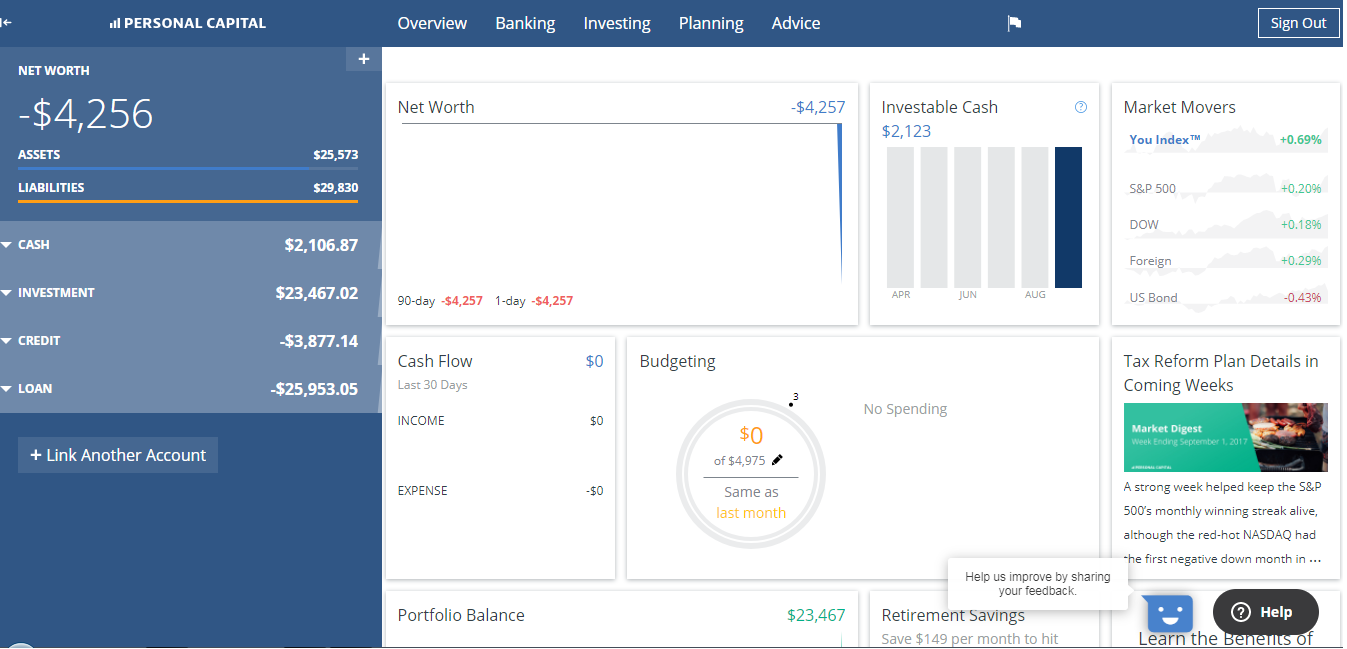

Now we did choose someone that had pretty simple assets and debt to make things a little easier to follow and less complicated. Lets take a look at the break down of our candidates Assets – Liabilities to determine their Net Worth using Personal Capital (Spoiler their net worth currently is negative).

Net Worth

Assets

What made up the assets above were from two main sources: cash and investments. The cash is income from an employer. The investments our volunteer accumulated over time and are from an IRA brokerage account and a regular brokerage account.

Note: these assets will fluctuate up or down since cash is very liquid and the investments will move depending on the market and additional added capital.

Total Assets as of 9/3/2017: $25,573

Liabilities

Consisted of credit card debts, school loans, and a personal loan. We are happy to share that our volunteer utilized one of our tips in our 50 Awesome Ways To Save Money post. They were able to consolidate some of their high interest debt with a 0% interest balance transfer for 15 months with one of their credit cards for about $2,500.

They further consolidated their debt by taking out a personal loan for $11,000 with a lower interest rate through their bank. The bank offered a cheaper rate than what they were paying, but nothing spectacular because that is how banks make their money. I believe the interest on the loan was somewhere between 10% – 12%, which is cheaper than the interest on the credit cards.

Total Liabilities as of 9/3/2017: $(29,830)

Total Net Worth

As you probably can see and if you remember my earlier hint our volunteer’s net worth is negative. Meaning he has more liabilities than he does assets.

Total Net Worth as of 9/3/2017: $(4,256)

How Do We Compare?

As much as we like to compare ourselves to others, (thanks to social media and human nature) it is hard to do when it comes to net worth. Several factors and priorities play a key role in determining someones net worth. For example, Per U.S. Census Bureau the last few years, most household net worth is somewhere between $70,000 to $80,000. The biggest contributing factor is due to home equity. In our example, our volunteer does not own a home yet.

Other factors can be education which helps your career. The personal value you someone place on education is hard to measure. It is fact that Americans have a tremendous amount of school loans that weigh down their potential net worth. It is also true that there is a huge pay gap between people who do not have high school diploma vs. those who do; those who have high school diploma vs. those who have college degree and so forth….

Your spending habits can cause an adverse relationship to your net worth, so income some times is not a factor.

Point is the more you are able to make/manage will increase your chances of having a higher and more positive net worth. The many factors that make up someone’s net worth is too vast and not always cut and dry.

What Next?

Coming back to our volunteer he was able to see his numbers and wasn’t totally bum’d about the net worth figure. The same could not be said about the liabilities. Specifically, the credit cards and the personal loan they had take to pay down the high interest cards.

There are two main ways our friends can effect their net worth balance: Making more money which involves increasing their current income.

As of now they currently have one income source. We believe in multiple streams of income (always) and look forward to guiding them to different revenue streams.

The other way to create a positive net worth is to save and cut cost. Again, 50 Awesome Ways To Save Money offer some great practical ideas on saving and increasing money.

Breaking down their financial information they realized that they had been spending more than they were comfortable with.

Their Goal is not necessarily to focus on the net worth, but rather cutting down the almost 30K in debt. They are up for the challenge to try and knock down $23K in six months. That brings us to a deadline in March 2018.